Digital Government Borrowing Partnership Debuts Worry about-provider Home loan Webpage Dcu Mortgage App

Our well worth suggestion very arrived right down to you to definitely sentence, which is, we need to getting known for rates and you can service having fun with electronic units and technical, said Sorochinsky, that is direct out-of mortgage financing with the $a dozen.1 mil-advantage DCU.

DCU officially introduced brand new notice-provider mortgage site in 2022 once using a year piloting brand new program so you’re able to optimize the fresh new process. The fresh digital credit system, dependent by the New jersey app agency Bluish Sage Selection, capitalizes into the borrowing from the bank union’s user direct model by allowing possible individuals to apply for mortgage loans and you will family security finance and you can re-finance established loans, without needing a staff member.

Just after searching for and this of your own about three activities they wish to apply to possess, and inputting possessions facts including postcode, expected downpayment and you will projected cost, consumers are able to see the maximum amount they might bid on a great property and pick and that costs and you will words ideal complement their demands. It phase together with allows professionals to help you electronically ensure their money, a career and other owned possessions to help with their qualification.

Inside the app techniques, borrowers concerned about industry volatility normally secure their rate playing with OptimalBlue’s rate secure API, to own 15 to help you ninety days.

Next, DCU uses Bluish Sage’s combination towards financial fintech Maximum Blue’s product and you will costs engine make it possible for people to evaluate and you may look for the popular mixture of loan words and you can costs. A holiday API experience of all the info characteristics company ClosingCorp will bring added help from the figuring app and you short term loans online can appraisal charges including promoting revelation plans to your affiliate in order to indication.

Members can get letters or texts compelling these to go-ahead to the next steps in DCU’s financial portal and you can sign the expected forms adopting the 1st application is registered. Just like the fees are paid, orders are put in for basic circumstances as well as term insurance policies, appraisals and you may flooding permits, following one minute round away from confirmation data files is actually delivered back so you can brand new candidate to possess finalizing.

Immediately following finalizing the expected models, the fresh document is published to new underwriting service for additional running – and therefore DCU states you could do in as little as 29 times and you will without needing a card union member. Two-method communication with good DCU mortgage financing officer, processor otherwise nearer via a chat setting, also educational video clips, are available to enhance the affiliate address one products.

No matter what the new forces try, market meltdown or high pricing or reasonable inventory, we could be effective due to the fact we are emphasizing speed and you can solution playing with electronic gadgets and you can technology, Sorochinsky said. By the addition of the new thinking-service site, DCU was able to raise financing off roughly $1 mil from inside the mortgages when conversations began inside the 2019, so you can $step 1.6 million into the 2023.

DCU is regarded as many almost every other institutions which have additional this new technologies on expectations of furthering membership growth and you may increasing loan regularity

During the first app processes, people was prompted in order to type in property details like zip code, envisioned down payment and you may projected price to search for the maximum number they may quote towards the a house. (Digital Federal Borrowing from the bank Commitment)

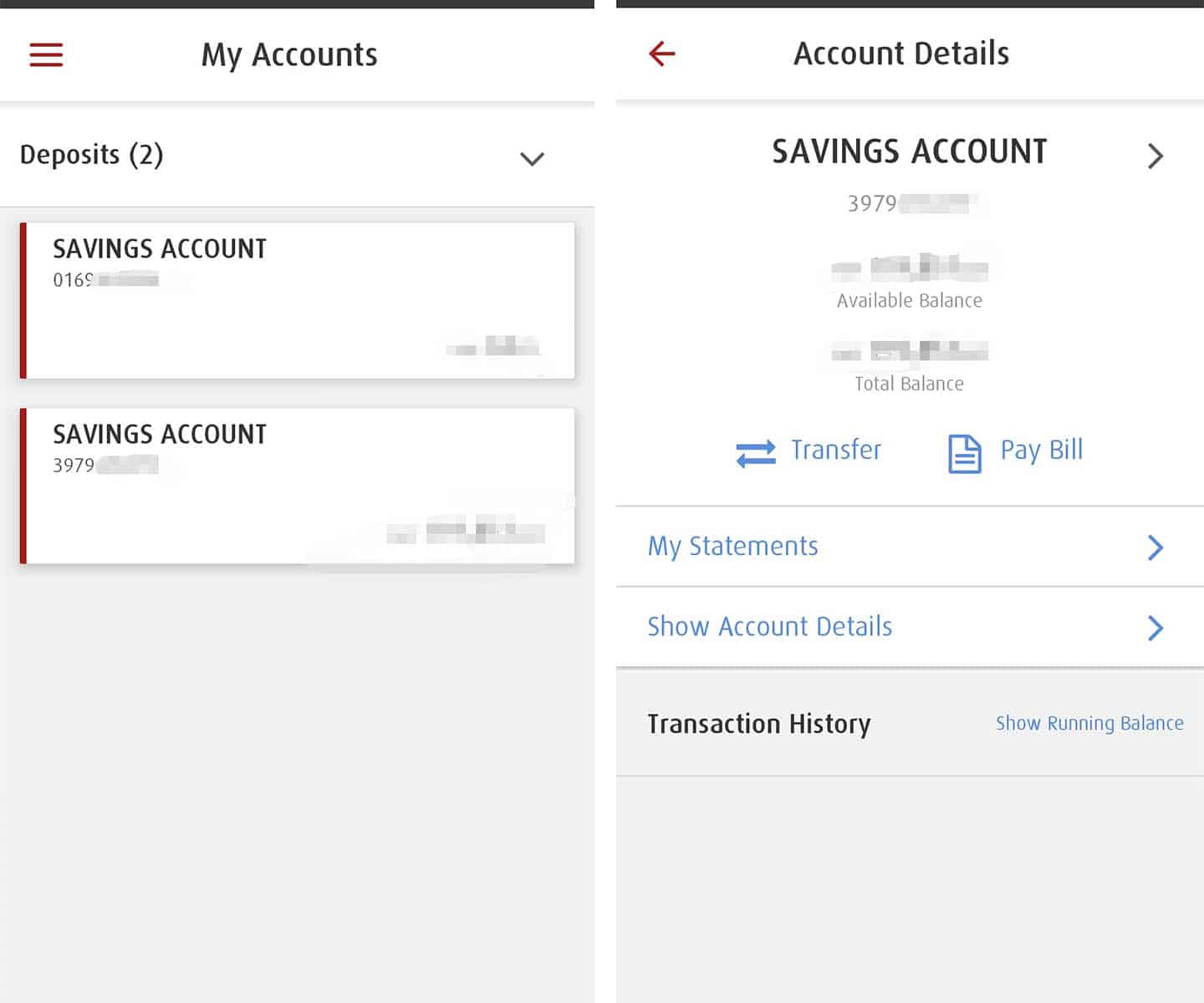

Professionals can watch the latest updates of the application for the loan and discover most other info like loan amount, interest rate and you will estimated monthly payment. (Electronic Government Credit Relationship)

In the speed secure section, supported by Max Bluish, customers can choose from many different lock words and rates factors to match their demands. (Electronic Federal Borrowing Union)

Participants struggling to navigate the new portal or the software techniques can speak immediately which have a good DCU affiliate. (Electronic Federal Borrowing Commitment)

Candidates normally digitally sign requisite disclosures or any other files, whilst electronically guaranteeing their money and you can employment. (Digital Federal Credit Connection)

, like, been able to develop core subscription by the twenty-two% and raise deposits of the more $five-hundred million inside the a half dozen-week several months with the aid of the fresh York-oriented membership starting fintech MANTL’s put origination system. The fresh Providence, Rhode Isle-based

When Jason Sorochinsky first started converting the latest Marlborough, Massachusetts-founded Electronic Government Borrowing Union’s home loan origination process from inside the 2019, the guy know that usually offering the lower rates wasn’t possible

while the signaled rates decreases gives cure for straight down mortgage cost – spurring most recent borrowers in order to refinance having a advantageous top.

Today, individuals keep in mind that home is a superb financing [as] it offers them new liberty to make where you can find their desires, make use of income tax positives and create wealth over time, Shultz said. The ability to refinance its loan on the a reduced rate into the the next step 1-2 years try possible.

Positives which have Foundation Advisors and you will Datos Knowledge underscored the importance of right research when vetting one another third-cluster providers plus the circumstances they bring to this new dining table, but equally showcased the value of examining brand new technology.

It seems like a zero-brainer however, even with system potential, many underwriters however manually pull borrowing and you can estimate rates by hand, said Eric Weikart, companion at Cornerstone Advisors. Sometimes, simply because system settings points but the majority of minutes it is while they have always done it like that and they commonly happy to changes.

Automation is an important feature having underwriting software to be its effective, but just with full exposure review, regulatory conformity and obvious guidance together with set up, told you Stewart Watterson, strategic advisor to own Datos Information.

Compared to the 20 otherwise 30 years back, individuals have a much higher expectation away from speed so you can acceptance and you may closing plus desire to have an innovation permitted techniques served of the educated, top-notch mortgage officers and operations group, told you Christy Soukhamneut, captain financing manager towards $4 billion-resource College or university Federal Borrowing Commitment when you look at the Austin. We’re actively using mortgage technical which is simple to use and you will intuitive in order that our very own conversion groups can be focus on the user and suggestion partner sense.