Why does Boosting My personal Credit score Feeling My personal Annual percentage rate?

Lenders be more happy to undertake dangers whenever financing as a consequence of new FHA financing system once the funds are insured by regulators payday loans Ophir. The borrowed funds financial will get paid back even if the borrower misses costs otherwise non-payments.

For people who meet the system conditions, FHA money are a good way to get been for the assets steps. You can refinance to raised terms and conditions once your credit score improves.

Virtual assistant Home loans

A beneficial Va mortgage is an alternative style of home loan applied by Pros Management. Such money are available to people who have fair borrowing and assist you buy property no advance payment.

Because Virtual assistant finance is actually to have veterans, you need to satisfy specific armed forces service standards. Such as for example, you can get a good Va loan from the helping regarding military to own 181 months or more throughout peacetime, ninety days during wartime, otherwise spending six many years about reserves or Federal Shield.

Military spouses can be meet the requirements when the their partner dies regarding the range out of duty or down to a help-associated impairment.

USDA Mortgage brokers

USDA lenders are around for consumers who would like to get a home inside a rural town. The application form is intended to help help quicker metropolitan parts of the nation.

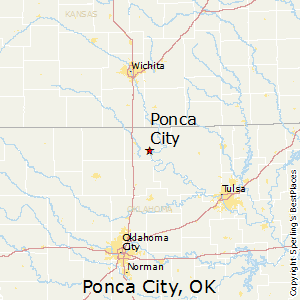

Even though you is not able to maneuver for the urban area with a beneficial USDA mortgage, the application is an excellent choice for people that wanted a a whole lot more outlying life. Needed the absolute minimum credit rating away from 640 in most cases. Although not, you could dodge you to requirements when you have extenuating products.

To meet the requirements, you’ll need an overall debt-to-money ratio off 41% otherwise less, along with your mortgage payment are unable to surpass more than 29% of terrible month-to-month money. You also need to incorporate proof of consistent income over the earlier in the day 2 yrs.

Borrowing from the bank Unions

Borrowing from the bank unions are just like financial institutions, but they’ve been belonging to people who’ve membership at borrowing from the bank connection as opposed to investors. This will make them far more happy to manage users that happen to be discussing strange factors.

Working with a region borrowing from the bank connection can be a good choice for those who have less than perfect credit. Your borrowing from the bank commitment should be significantly more involved in the community than just a massive bank and more happy to work with you.

That does not mean that each borrowing from the bank commitment usually provide to help you someone who wants home financing, however it function you’ve got a far greater danger of having your base throughout the door, especially if you have been a long-day member of the credit partnership.

Just like almost every other loan providers, be prepared to build a bigger down-payment and you may deal with increased mortgage rates if you get that loan that have a good borrowing from the bank records.

In the event your combination of an advance payment and settlement costs try a lot of, certain lenders allow you to get a zero closure rates financing in return for a high rate.

Boosting your credit history may have a huge effect on your own Apr. Regardless if you are delivering a home loan or a personal bank loan, a lender should determine the interest rate it costs considering every piece of information on the credit history.

Envision you want to borrow $500,000 to purchase a home around. Here’s what you certainly will spend considering your credit rating.

Mortgage loan Repayments because of the Credit score

Which have fair borrowing from the bank mode paying $439 with each monthly mortgage repayment and most $150,000 additionally the life of one’s financing. If you get a loan that have less than perfect credit it will be even bad.

Despite mediocre borrowing, you are paying alot more for a home loan. It is to your advantage to be hired on the increased credit score before applying for a giant mortgage such home financing. Having a minimal credit rating helps it be much harder so you’re able to afford a house.