More youthful mother-to-end up being takes care of their unique education loan loans out-of $120K: ‘Focus to the almost every other existence goals’

Maryland mother-to-feel suggests way to freedom away from education loan loans

- Comments

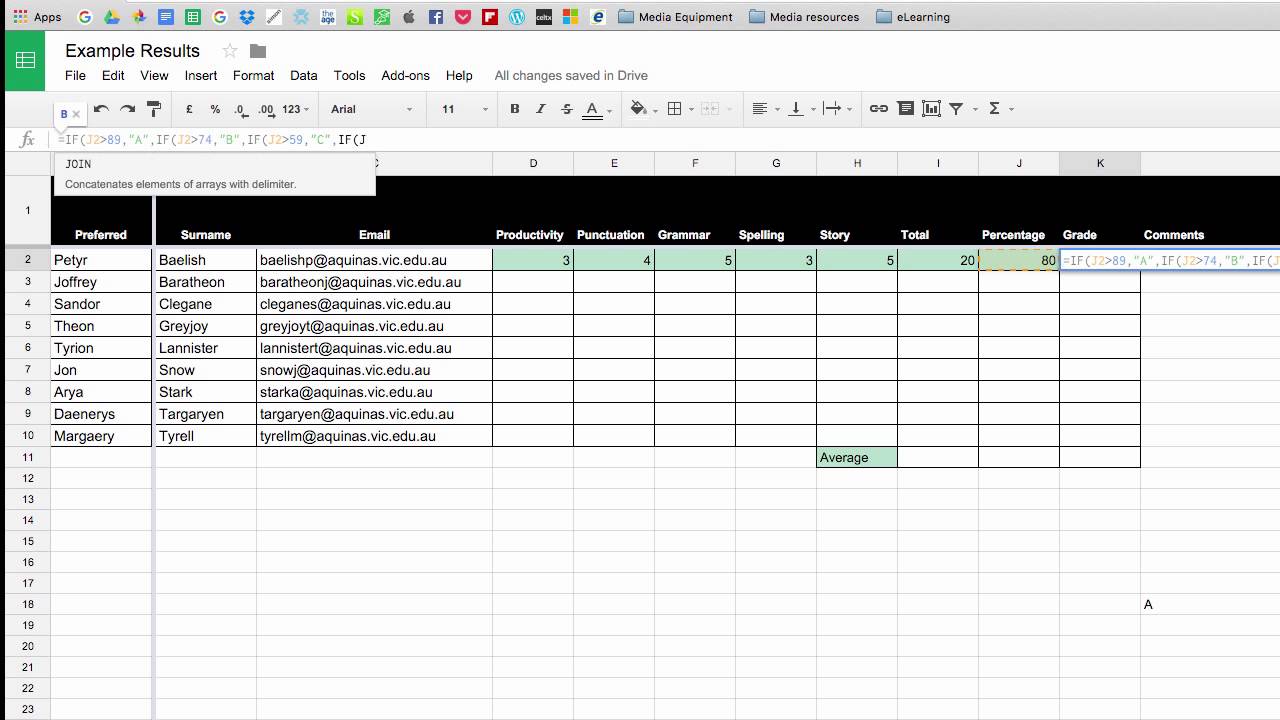

Cost of Biden’s education loan bailout anticipated to be more expensive than simply $step one trillion

Chairman of your own Cardio getting Renewing America Russ Vought problems claims of the Biden government that the student loan bailout is reduced to own.

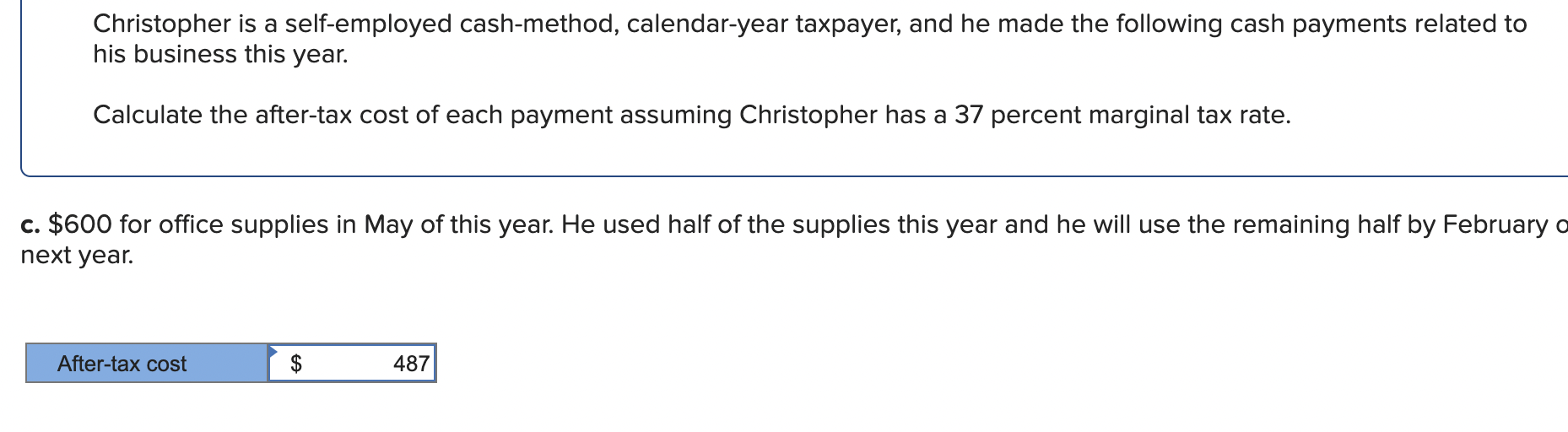

An early Maryland woman just who has just bought a house along with her husband as they get ready for the brand new birth of the earliest youngster was happy you to she developed the financial acumen to settle their student loans entirely – regardless of highway you to anyone else may be bringing.

Found in the Washington, D.C., urban area city, Micah (exactly who requested you to their own history name not utilized) performs since the a builder on monetary functions industry. Into the a job interview, she told Fox Reports Electronic one she’ll often be proud of their unique accomplishment away from paying a whopping $120,000 within the student loan loans – and that she know moving in it absolutely was their unique obligation to do this.

“Into the economic independence of getting paid down my education loan obligations, I could focus on other lifetime requirements,” said Micah.

She added of their unique financing, “I decided to make go pay it back given that I simply failed to need anything growing over my personal lead when it comes out of imagine if?’ later on. I wanted to invest it well and start to become from that state.” She asserted that using this arrives “assurance” getting her.

Your debt she incurred earlier on got their unique thanks to school (School regarding Ca, Berkeley) and additionally scholar college or university (Columbia College or university School out of Societal Operate in New york city), she said.

Micah regarding Maryland paid down their particular college and scholar university financing totaling $120,000 – now she and her husband expect its basic child. “I am able to work on most other lives goals,” she told you from the delivering college or university obligations behind her. (Fox Reports Electronic)

Their own bring-charge mindset and you will feeling of personal responsibility inside paying off their personal debt is actually significant because of the Biden administration’s present announcement which manage “forgive” a lot of education loan obligations to have 10s from hundreds of thousands of consumers all over the country.

The fresh management, as an element of that it education loan handout plan, as well as told you it can stop financing installment obligations toward others with the season.

Micah said she know even before their particular first 12 months of college or university, when she are 17 yrs old, you to she would bear brand new economic burden out of paying for their own college degree.

However, a week ago, the nonpartisan Congressional Funds Place of work told you the application will surely cost on the $eight hundred million along side next three decades – although this new White House said the brand new CBO’s imagine of your $21 million the plan costs in its first year by yourself is gloomier than the government very first requested.

With little to no fanfare, the newest government recently scaled right back the newest qualification standards getting scholar debt settlement. Now, borrowers having finance protected because of the authorities however, kept from the personal lenders commonly entitled to financial obligation cancelation, according to Training Agency.

Meanwhile, the nation’s federal student debt is topping $1.6 trillion after ballooning for years – while the national debt, according to the Treasury Department, is already in the $30.seven trillion.

Has worked 3 efforts to expend her way owing to university

Micah told you she knew before their own first 12 months out-of college or university, whenever she try 17 yrs old, one to she’d happen the brand new economic weight from paying for their very own college degree.

She grew up in just one-mother or father household, she told Fox Development Digital, and you may early on, just before their particular freshman seasons away from college or university about fall from 2007, their mother seated her down https://paydayloanalabama.com/fairfield/ and you will talked so you’re able to their own about the can cost you involved.