Lowest Put getting a home loan around australia: Ideas on how to Get ready

Ahead of initiating the application form, examining your credit score to learn your borrowing energy was sensible

While overseas, its all of the expat’s mission to return in order to Australia within the a great comfortable status, and you can section of it comfort has good property in order to move back again to and never signing up for the fresh new ultra-aggressive rental industry. The question that expats next features was: Just how much should i save to make certain I’m able to spend the money for house I want? This short article helps to break apart various considerations out of protecting to suit your minimum deposit to have a mortgage around australia.

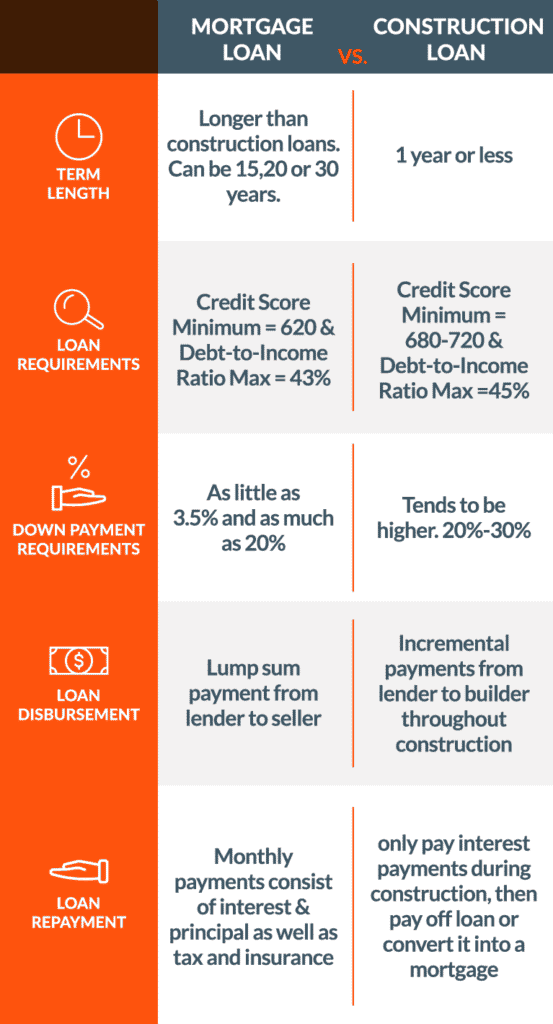

A home loan put is the amount of money you lead into the purchase price out of property. Lenders wanted a deposit to help you safe a home loan. The fresh deposit can also influence the kind of financing and you will attention speed which is often appropriate to you personally.

The average put count loan providers require is between 5% in order to 20% of your property’s price. Extent requisite are very different with respect to the financial and your individual items. The mortgage to Really worth Ratio (LVR) is also an important facet within the deciding the necessary put.

They acts as shelter to the bank and you may indicates that you has monetary stability in addition to capacity to build payments

The brand new LVR ‘s the level of the borrowed funds compared to the value of, conveyed as the a share. Such as, if you have a deposit from 20% of the property worth, the LVR might be 80%. Essentially, the reduced the new LVR, the greater your chances of recognition additionally the much more favorable their rate of interest.

Around australia, for folks who obtain a lot more than 80%, lenders often costs Lenders Financial Insurance policies (LMI). This insurance coverage covers the lending company any time you standard on your mortgage while the value of your residence adopting the income is lower as compared to the mortgage harmony. Even though it is insurance policies to safeguard the financial institution, the fresh debtor must afford the premium to own lender to the added bonus so you’re able to lend more than 80%.

Having expats, the fresh put goalposts disagree significantly ranging from banking companies. The general laws is that very loan providers you would like the very least 20% put. But not, having plenty of, you may need a deposit of up to 31% if not forty%, as well as features funds for the stamp responsibility. Specific loan providers tend to envision less than a 20% put with LMI; although not, talking about quite few, once the financial insurance providers generally hate to help you ensure overseas borrowers.

To estimate just how much you should save yourself to have a deposit, dictate the fresh new commission your own bank need centered on your unique affairs. Next, proliferate this by the cost of the house. Plus the put, you must prepare for upfront can cost you for example stamp responsibility, judge charges, or other associated costs. It’s best to perform some research and just have a quote away from these can cost you before you begin to store.

You could normally select stamp responsibility and other prices calculators on the web otherwise speak to your mortgage broker and inquire these to focus on certain quantity to you personally.

Instance, if you were to find to own $500k and you may wished to rescue to suit your 20% and can cost you, and you can stamp obligations are $20k, you then will want at least $120k to help you proceed with the potential purchase.

Entering the property business, particularly for first-big date homebuyers, have a tendency to hinges on just how much deposit you must shell out. A common misconception is the fact a giant deposit is essential having a home loan app. However, you’ll find lenders that will think at least deposit regarding merely 5%. Examining your financial situation as well as provides you with insight into their skill to repay your residence loan daily. It’s advisable to look for independent courtroom and you can monetary recommendations to be sure the loan aligns with your objectives and you may monetary activities.