Practical ROE Analysis: That Boosts Investment Returns

Such a scenario necessitates a thorough review to identify and address the underlying issues impacting profitability. Though ROE can easily be computed by dividing net income by shareholders’ equity, a technique called DuPont decomposition can break down the ROE calculation into additional steps. Created by the American chemicals corporation DuPont in the 1920s, this analysis reveals which factors are contributing the most (or the least) to a firm’s ROE. A negative ROE due to the company having a net loss or negative shareholders’ equity cannot be used to analyze the company, nor can it be used to compare against companies with a positive ROE. The term ROE is a misnomer in this situation as there is no return; the more appropriate classification is to consider what the loss is on equity.

Why do investors look at ROE?

ROE is expressed as a percentage and can be calculated for any company if net income and equity are both positive numbers. Net income is calculated before dividends paid to common shareholders and after dividends to preferred shareholders and interest to lenders. By analyzing various financial ratios, you can gain a better understanding of a company’s performance and make informed investment decisions. It is crucial to benchmark the company’s ROCE against industry standards to gain valuable insights.

A Practical Investors Guide to Return on Common Equity (ROE)

For that reason, investors often look at complementary metrics, such as ROIC, to help understand the full picture of the business. ROCE should be evaluated regularly, alongside other financial metrics, to monitor a company’s performance and identify trends over time. ROE is sometimes used to estimate how efficiently a company’s management is able to generate profit with the assets they have available. Therefore, investors should analyze ROCE in conjunction with other financial metrics and industry benchmarks.

Q: How can a company improve its return on common stockholders equity?

While a higher ROCE generally indicates better performance, it is essential to compare it with industry benchmarks and consider other factors to assess a company’s overall financial health. Yes, a negative ROCE suggests that a company is not generating sufficient returns to cover the cost of equity capital. This indicates that for every dollar of equity invested by shareholders, the company generated 20 cents in profit. Because shareholder equity is equal to a business’s assets minus its debts, ROE can also be considered the return on net assets.

Additional Financial Metrics

Return on Equity (ROE) is a revealing financial ratio that illustrates how effectively a company utilizes its equity base to generate profits. It is a key indicator of managerial efficiency and a company’s potential for long-term value creation for shareholders. In the realm of financial analysis, ROCE is more than just a percentage—it’s a window into the operational effectiveness of a business. It uniquely focuses on common shareholders, disregarding preferred shares and other forms of equity. Net income over the last full fiscal year, or trailing 12 months, is found on the income statement—a sum of financial activity over that period. Shareholders’ equity comes from the balance sheet—a running balance of a company’s entire history of changes in assets and liabilities.

When ROE Can Be Misleading

Enhancing operational efficiency and keeping a tight rein on expenses will directly benefit net income. Simultaneously, strategic financial management aimed at optimizing the equity base can further magnify ROCE. Both the three- and five-step equations provide a deeper understanding of a company’s ROE by examining what is changing in a company rather than looking at one simple ratio. As always with financial statement ratios, they should be examined against the company’s history and its competitors’ histories. In rare cases, a negative ROE ratio could be due to a cash flow-supported share buyback program and excellent management, but this is the less likely outcome.

This is often beneficial because it allows companies and investors alike to see what sort of return the voting shareholders are getting if preferred and other types of shares are not counted. Return on Common Equity (ROCE) is a key financial metric that measures the profitability and efficiency of a company by assessing the returns generated from its common shareholders’ equity. So a return on 1 means that every dollar of common stockholders’ equity generates 1 dollar of net income.

- The outcome of the ROE equation indicates how well a company leverages its equity base to generate earnings.

- Understanding this calculation is essential for investors evaluating a company’s profitability relative to shareholder equity.

- Finally, about the stock market, you will notice that a high ROE will increase the stock price.

ROCE is a critical financial ratio that measures a company’s profitability and efficiency in utilizing its equity capital. Investors should also consider the limitations of ROCE and avoid common mistakes while using it as a performance indicator. ROCE may witness new trends and developments, such as the impact of ESG factors and customized benchmarks, in the future. Therefore, investors should stay updated and adopt a comprehensive approach to analyze ROCE effectively. Return on common equity is a measure of how well a company uses its investment dollars to generate profits.

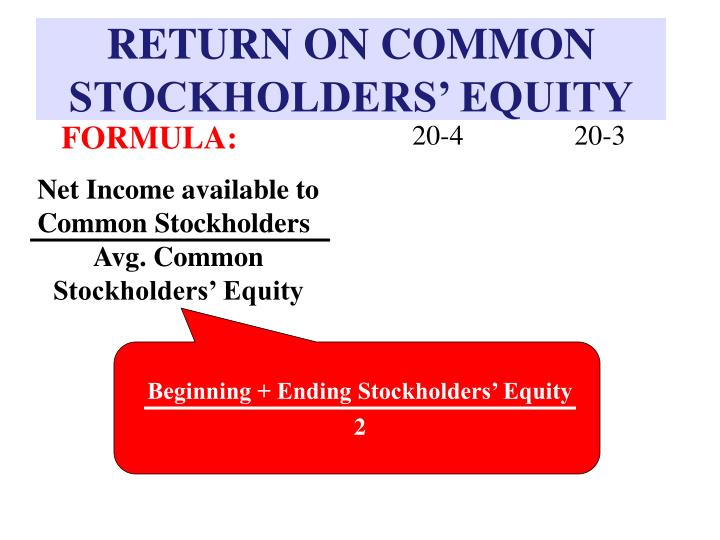

Directly linked to a company’s financial decisions, it is influenced by several key financial metrics. To calculate ROE, divide the company’s net income by its average shareholders’ equity. Because shareholders’ equity is equal to assets minus liabilities, ROE is essentially a measure of the return generated on the net assets of the company.

ROA measures the company’s ability to generate profits from its assets, while ROCE indicates how efficiently a company is using its capital to generate profits. To calculate the ROE, the net income of a firm is divided by the common shareholders’ equity. This equity ratio analysis is a useful tool for charitable tax deductions both investors who already own shares in a company and those who are considering it as an investment opportunity. Higher ROE metrics relative to comparable companies imply increased value creation using less equity capital, which is precisely what equity investors pursue when evaluating investments.

Return on Equity (ROE) measures the net profits generated by a company based on each dollar of equity investment contributed by shareholders. Return On Equity, or ROE, is a measurement of financial performance arrived at by dividing net income by shareholder equity. Company growth or a higher ROE doesn’t necessarily get passed onto the investors however. If the company retains these profits, the common shareholders will only realize this gain by having an appreciated stock.