All of the three conditions (1%, 2% and you can 5%) echo new FHFA advised extended definition of home mortgage financing

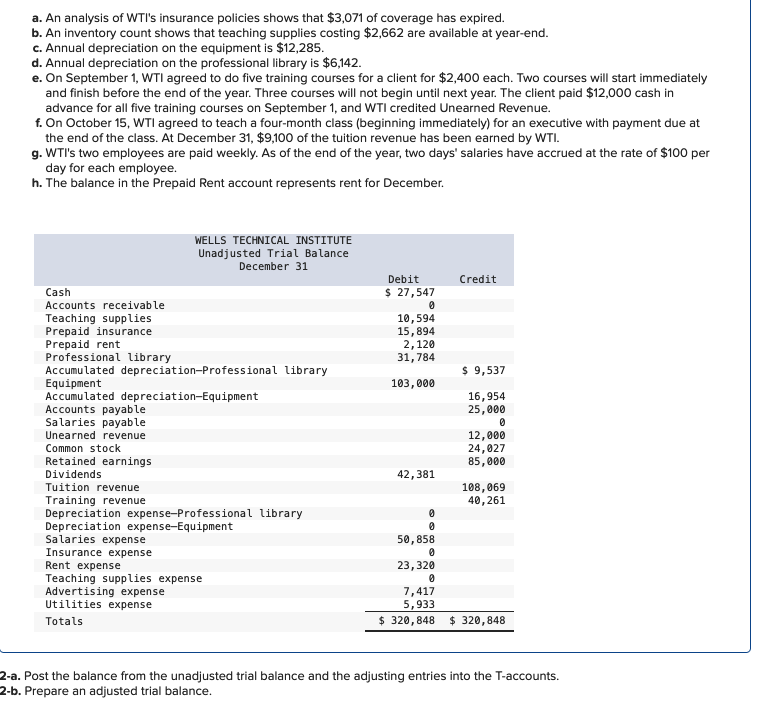

The brand new FHFA undertook a study to select the impact of your own minimum HML holdings offer. The following chart shows just how many establishments who happen to be already participants will be noticed Non-Certified in line with the minimal HML demands suggested in the NPR. The brand new FHFA offered this post by using the annual report data to have 253 of 284 insurance companies that have been Bank participants just like the off , including you to 14 of one’s 29 insurance provider professionals, whereby zero data try readily available, was captives. This new FHFA in addition to stated, though failed to assess, that when current meaning try chose (i.elizabeth., only if admission-courtesy ties try mentioned in the place of all sorts of MBS supported because of the qualifying fund), this new percentage of insurer professionals who would then frequently getting out of compliance is large.

To have insurance firms Of course around 50% out of NAIC analysis for finance covered from the mortgage loans into step 1-cuatro nearest and dearest or multifamily characteristics try step 1 st lien, hence meet the requirements once the mortgage loan money, upcoming non-conformity will be lower, considering FHFA study.

The expression eligibility since it would relate solely to insurance firms are as well as a focus that’s relevant into insurance business. Owing to history, the new NPR claims one insurance agencies was indeed authorized to get part of the fresh new FHLB program given that the first in 1932. Depending on the FHFA, insurers comprised 14% out of FHLB enhances for the 2013, upwards from 1% for the 2000. You’ll find already around 293 insurers regarding the FHLB system having everything $59 million within the advances. The newest suggestion represent an insurance coverage business since the a beneficial organization that has as the top company the new underwriting from insurance to have non-associated individuals. During the this, brand new FHFA says it is trying to ban captive insurance businesses, that it says act as a motor vehicle certainly low-eligible participants to get registration (playing with REITs by way of example). Insurance vendors appointment this meaning that are already participants will be subject to good 5 seasons phase aside with no additional companies fulfilling the definition will be invited just like the people should the advised statutes become given.

Business New member Reactions, Comments and you can Resistance

Brand new NPR needs FHLBs https://paydayloancolorado.net/woody-creek/ and you will most recent users exactly the same to provide their comments towards the all aspects of one’s recommended laws for them to to consider in advance of giving a last rule. But not, this new FHFA may not you need consensus to move pass to the change. The newest review months with the current proposals had been longer two months, bringing the total feedback months to help you 120 days, stop in the . Similar to the result of the initial ANPR issued this current year, it looks most FHLBs and their members come in opposition to new FHFA suggested laws.

- The potential constraint away from funds available for property and you may area innovation and its implication to own standard field exchangeability and you will economic gains supposed give

- The reduced attractiveness of being in the application offered improved government, conformity and advantage standards

- Objections you to governing limitations with regards to security criteria for improves currently occur and therefore are energetic

- Insufficient clarity in what constitutes an attentive insurance provider

- Inquiries over the FHFA’s capability to enact the changes (unlike Congress)

Conclusion

Right now it is undecided just what consequence of the fresh NPR could well be. The brand new FHLB program has been in spot for many years and you can goes on to provide competitive investment to help you their users. The brand new NPR, if you’re creating an even more planned framework to have membership qualification, does not change this mandate. As stated, new remark several months stretches toward new-year, and you will comparable proposals had been prior to now confronted with resistance and ultimately not implemented. Yet not, when the followed, the principles you could end up possibly fewer of your latest people getting qualified moving forward. Concurrently, the rules you are going to a bit transform mortgage associated investment stability for the equilibrium piece out of established players who may well not currently meet up with the proposals since designed but choose to do so to retain its registration.