Trust Action: What it is, The way it operates, Example Setting

What exactly is a count on Deed?

A believe deed -labeled as an action away from trust-are a document either used in real estate purchases on You.S. It is a file which comes to the play when one-party has taken away a loan regarding yet another group to purchase an excellent property. Brand new believe deed represents an agreement between the borrower and you can an effective lender to obtain the property held inside faith from the a natural and you can separate third party up until the mortgage is actually reduced.

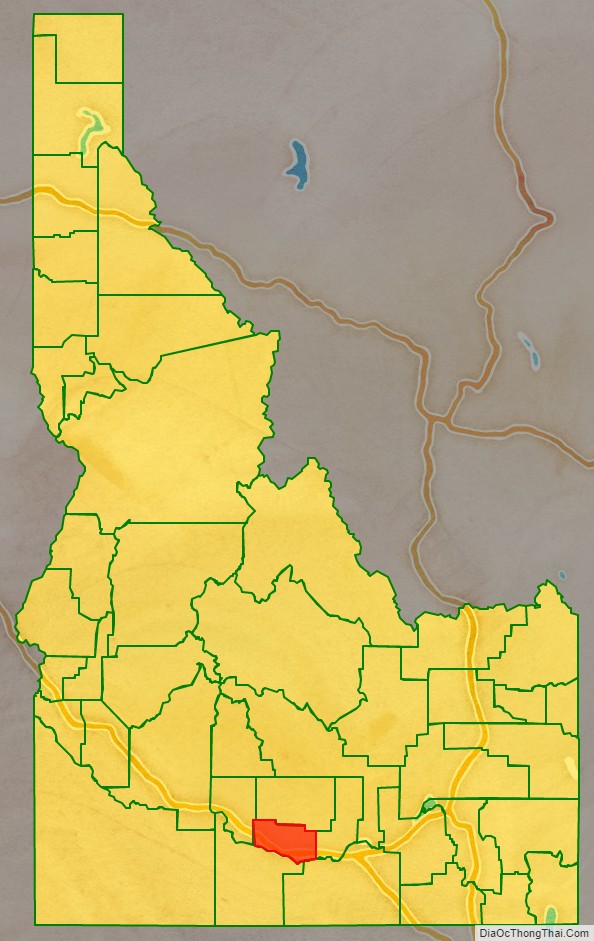

Regardless if faith deeds is actually less common than it used to be, some 20 states nonetheless mandate using you to, rather than home financing, when investment is actually mixed up in purchase of a residential property. Believe deeds are all inside the Alaska, Arizona, Ca, Tx, Idaho, Illinois, Mississippi, Missouri, Montana, New york, Tennessee, Texas, Virginia, and you can West Virginia.

Secret Takeaways

-

https://paydayloanalabama.com/daphne/

- During the financed a house transactions, trust deeds transfer new courtroom term away from a property to a good third party-like a bank, escrow business, otherwise label team-to hang through to the borrower repays the personal debt to the lender.

- Believe deeds are used in lieu of mortgage loans in a lot of says.

- Committing to believe deeds provide a leading-producing income weight.

Skills Faith Deeds

- Loan providers, theoretically known as beneficiaries. These represent the hobbies a rely on is meant to cover.

- A borrower, otherwise known as a trustor. This is actually the person that establishes a confidence.

- Good trustee, an authorized charged with carrying the new entrusted property up to a beneficial loan otherwise financial obligation is paid for entirely.

In a real estate transaction-the acquisition from a property, say-a lender offers the debtor profit exchange for just one or alot more promissory cards connected with a trust deed. It deed transfers court name with the real property to a keen impartial trustee, normally a name company, escrow business, otherwise lender, and this retains it as security towards the promissory notes. The brand new equitable term-the authority to see complete ownership-remains with the borrower, as does full use of and obligation on property.

It situation continues about repayment time of the financing. The new trustee retains new courtroom title through to the debtor pays new obligations in full, from which point brand new label on the property transfers on the debtor. Whether your debtor defaults into financing, the latest trustee requires full control of the property.

Trust Action against. Home loan

Faith deeds and you can mortgages is actually both used in bank and private funds for undertaking liens towards the a property, and you may both are normally filed because the loans regarding state where the property is located. However, there are a few variations.

Number of People

Home financing relates to one or two activities: a borrower (or mortgagor) and you will a loan provider (or mortgagee). When a borrower signs a home loan, it promise the property given that safety to your bank to be sure payment.

On the other hand, a count on deed concerns around three parties: a borrower (otherwise trustor), a loan provider (otherwise recipient), as well as the trustee. The new trustee retains title towards the lien into lender’s work for; should your debtor non-payments, the new trustee have a tendency to begin and you may complete the foreclosure process within lender’s consult.

Form of Foreclosure

If there is standard, an action regarding believe can lead to more foreclosures strategies than simply a home loan. An excellent defaulted mortgage will result in a judicial property foreclosure, therefore the financial will have to safe a legal buy. Trust deeds proceed through a non-judicial property foreclosure, so long as they tend to be an energy-of-purchases term.

Judicial foreclosures be a little more pricey and you can day-sipping than just low-judicial foreclosures. Because of this inside states that enable all of them, a deed out-of trust is superior to a mortgage from the lender’s perspective.