Score Our very own Specialist help towards Cellular Home financing in the Texas which have Bad credit if any Credit

Navigating the method to own mobile a home loan during the Colorado having bad credit will likely be hard to do if you don’t have every the newest methods to the questions you have: Is the minimal credit score good enough to possess a mobile domestic mortgage? Are there lenders which can be happy to run crappy borrowing without borrowing from the bank applicants? How can you get investment? Where would you put in a loan application for it? How do borrowing monitors work? What exactly is a chattel mortgage and how could it possibly be distinct from an enthusiastic FHA financial? What effect manage current higher interest rates provides to the mobile home finance inside the Tx?

World-class Land provides the responses you are looking for. We has helped hundreds of Texas group choose the best path in order to a mortgage due to their lender of preference. As we aren’t a funds providers, we could naturally assist our very own customers through the financial support process. We’ve brand new responses you prefer on how best to get a hold of are built home financing with poor credit inside Colorado after you acquire one of one’s the new land!

Features bad credit background with a bad credit get? We are able to let! Genuinely, you aren’t any get is typically rating investment to have a cellular house from the fundamental loan providers in the market. But it will not constantly sound right to do this as the interest and you will needed advance payment tends to be too much for your, particularly if obtaining a good chattel financing from inside the Colorado. When you yourself have at least credit score over 500 and good small down payment, constantly we can let find you appropriate mobile home financing which have bad credit during the Colorado at the a reasonable rate of interest. Nevertheless the best way knowing for certain is to utilize for a financial loan! For folks who call us now we could begin the applying procedure which help your manage a fresh credit score assessment as well.

Zero Credit history?Need Reconstruct Credit history?Let us Speak Now!

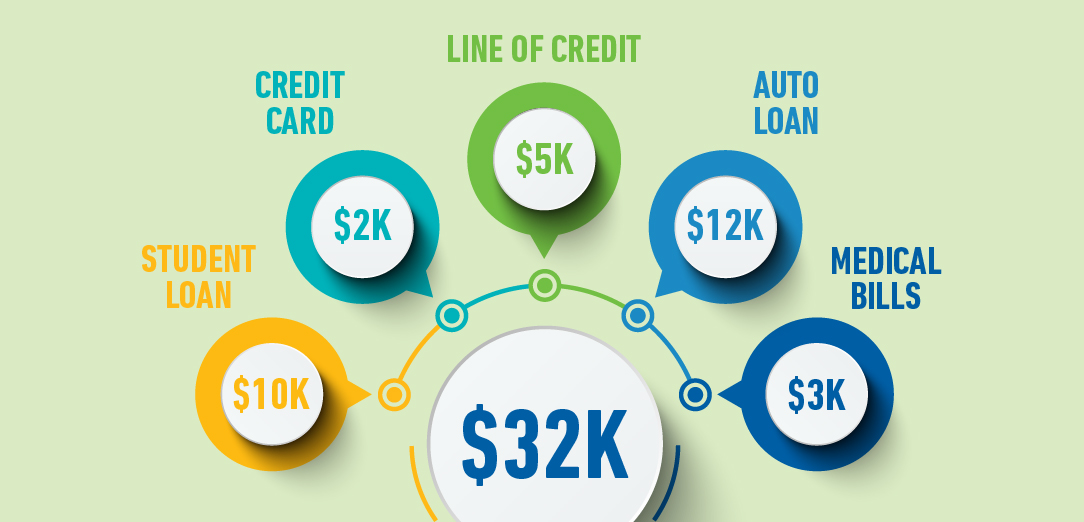

In case your credit score try super reasonable and you’ve got no deposit, we could help link your into the of good use men and women from the Second Action. They are able to help you take the proper actions to get able to find a cellular household from inside the Tx shortly after restoring the crappy borrowing from the bank otherwise gathering a primary credit history. Next step was a different low-earnings whose only objective try helping somebody manage to get thier profit within the acquisition to find a property. They’re able to help you augment your problem off not being in a position to help you safe mobile home loans that have bad credit in Tx. If you are being unsure of if you should get in touch with them, or move to a mobile mortgage app, call us and in addition we can be discuss your role and you can owning a home needs.

Interest rates Usually Personally Connect with Are designed Home financing Possibilities

High interest levels have a primary impact on mobile household financing repayments, no matter how particular mortgage you secure. If you have less than perfect credit or no credit, you will normally have a higher still interest on your cellular home loans on account of bad credit. This is certainly exacerbated by the current high interest rates about credit sector. This would generally feel correct for both chattel loans, FHA loans or other type of are manufactured home loans.

Instance, an FHA mortgage usually requires 3.5% of your own cost to put down while the a deposit, which is very affordable, but you’ll need to pay other loan during the most recent interest rates if you do not refinance later. That have an extended label financing appear more time getting appeal to help you gather. The total amount lent is probable gonna be much bigger after a higher interest rate financing than just with a short term loan within a lowered rate.

How can i Slow down the Aftereffect of High Interest levels For the My Home buying Process?

To attenuate the end result of interest rates on your manufactured house financial support plans, there are many choice you could need. installment loans in New York You can test spending far more at the start to own a shorter financing several months which have quicker notice costs, and thus faster total loan amount on home loan. You can loose time waiting for interest levels to go down seriously to an excellent level one have their month-to-month financing payments manageable for your newest financial predicament. You can manage Next step or any other business to improve your credit rating and you will lso are-apply for a lower life expectancy rate of interest chattel mortgage otherwise FHA mortgage. Eventually, you could prefer to go after your residence to purchase arrangements in any event having the vow out-of refinancing within a lesser interest rate about future If the pricing manage decrease.