Home Financing: Score a home loan Getting Home, Build your Fantasy Family

If you are searching to acquire home, you’ll likely score a secure loan. Listed here is all you need to find out about house fund.

If you are considering investing belongings, understanding the nuances out of homes financing is vital. Of eligibility requirements into various types of homes loans offered, there are important aspects in order to browse before carefully deciding. Whether you are eyeing some intense property to develop out of scratch otherwise thinking about increased parcels for the right industrial real property financial support venue, the latest ins and outs regarding residential property funds is also rather perception forget the. Very, before taking the next phase, its essential to grasp the ins and outs of it certified funding path to make advised alternatives you to definitely make with your homes acquisition goals.

To own informational intentions simply. Usually consult with a legal professional, tax, or financial advisor ahead of continuing having people a residential property deal.

Quick Strategies for Belongings Fund

- Residential property funds support the purchase from home-based or industrial property.

- Qualifications standards is a minimum credit history out of 720.

- Kind of homes fund become intense home, unimproved belongings, and you will improved property financing.

- Residential property money vary from framework financing inside their mission and you may official certification.

- Look lenders to own competitive prices and you may words tailored to property purchase.

What exactly is an area Financing?

Thus, you will be interested in house fund? A secure financing, known as a great deal financing, was an economic unit that will help get bare belongings to possess home-based otherwise industrial creativity.

This type of loans appeal to some property models, from brutal land to totally create parcels, offering another type of path so you can assets control otherwise broadening your business.

House Mortgage Qualification Standards

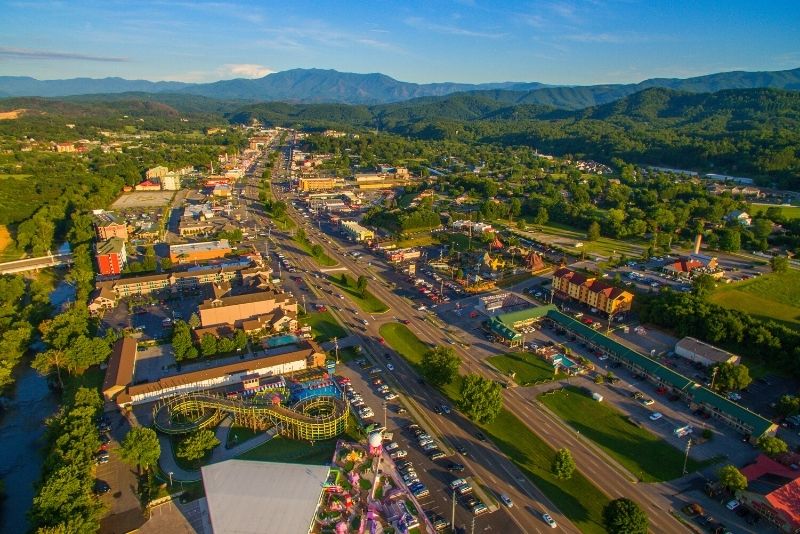

A land financing, labeled as that loan getting land buy, is specifically designed to invest in land buy getting domestic otherwise industrial innovation. In Tennessee, property finance render customized terms having competitive rates of interest, allowing individuals to help you secure money for undeveloped, unimproved, or enhanced property.

So you can be eligible for a land loan in the Tennessee, loan providers usually want the very least credit score of 720 and you can down costs between ten% so you’re able to 50%, with respect to the sort of property. It’s essential to look formal lenders and you will contrast terms and conditions to locate just the right fit for your property order requires.

Version of Home Finance

In terms of property money for the Tennessee, you have three first choices to choose from: the brand new Raw Land Financing, Unimproved Residential property Mortgage, and you can Increased Land Financing.

Every type serves additional homes development stages, giving varying levels of infrastructure and you may places. Understanding such variations will assist instant same day payday loans online North Carolina you to select the most appropriate mortgage for your certain house purchase demands.

Brutal House Mortgage

Raw Land Fund offer financial support to possess undeveloped belongings in the place of business and you will usually want high off costs versus other types of property finance. This type of fund is actually suitable if you are looking to shop for vacant belongings to have upcoming invention or recreational activities.

While the brutal homes lacks system particularly tools otherwise formations, lenders notice it as the riskier, and this the necessity for large down costs. Periodically you can buy a house that have good 5% down payment, however, this is simply not among them. If you are these finance provide the prospect of alteration and you can building your dream possessions away from scrape, they could include stricter degree conditions.

It is required to enjoys a solid plan for the latest land’s upcoming fool around with and you can creativity presenting to help you lenders when making an application for an effective brutal house mortgage.

Unimproved Residential property Mortgage

Investing in unimproved residential property as a result of that loan can offer solutions to own coming development and relaxation purposes, building upon the potential observed in intense property money. Unimproved residential property finance generally protection parcels which have very first tools but lacking comprehensive structure. This type of loans might require average down money and can serve as a means between raw and you may enhanced residential property.