If in case is a good time and energy to refinance?

step 1. Publication a time for you talk to a great Finspo Expert2. Write to us about yourself and supply the required docs3. Imagine our testimonial and select your own means

From that point, we’re going to take over and carry out the heavy lifting toward paperwork and you may contract actually toward bank on your behalf. That is true, that you do not have to speak with the lending company for many who should not!

Why don’t more folks refinance?

![]()

Music too-good to be real? Less than i have summarised some of the prominent explanations some one however avoid refinancing and just how we would be in a position to let.

If you’re able to rescue a buck is a great location to initiate. Refinancing is commonly good selection for individuals to view specific best marketing inside markets. Loan providers like an idle borrower whom stays with them for years paying their financing versus previously tricky them to score a great finest offer.

step 1. To track down less interest rate

It is not the majority of a secret that banking companies commonly costs the existing loyal people a great deal more than just their brand new of these. Indeed, the new ACCC has just found that the latest prolonged you have your loan along with your latest lender, more you pay.

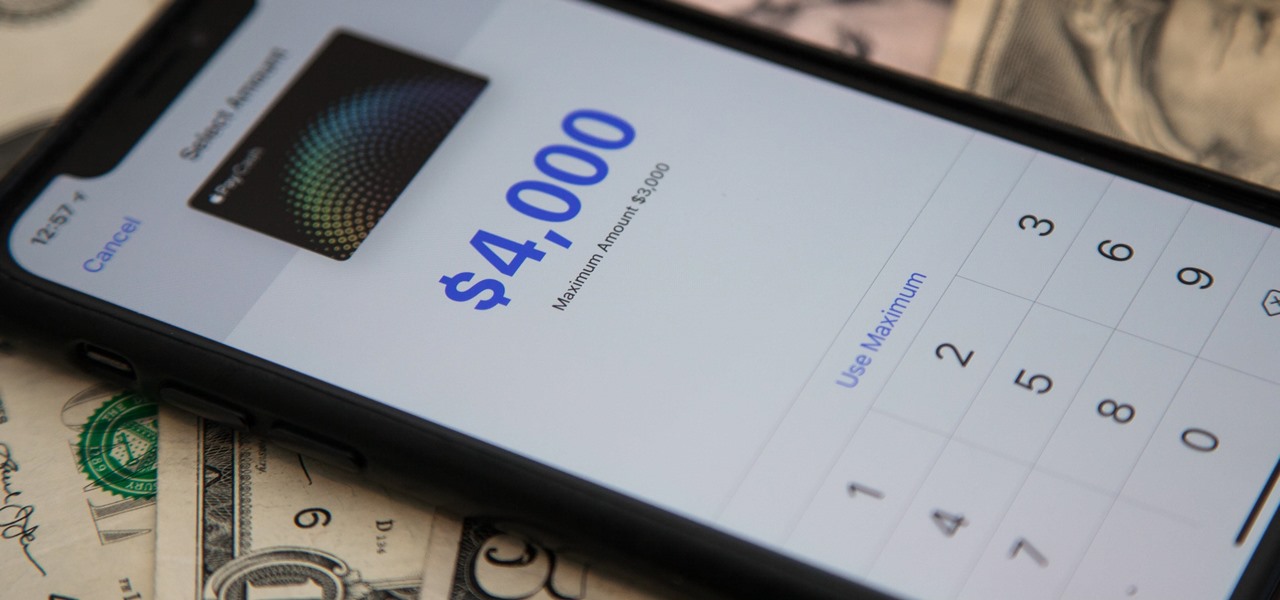

2. To gain access to a great cashback promote

Did you know many preferred banking companies can give you around $step 3,000^ in order to option your residence mortgage on them? Woah! That’s at the top of any coupons you may possibly make by also taking a reduced interest. However, you will need to and additionally principal site understand there can be will cost you related having modifying but commonly speaking of exceeded of the potential savings you might get to.

step 3. To get into security (otherwise cash) to fund one thing very important including a repair

Collateral is the difference between the worth of your house and how big is the loan you may have for this family. If you were paying down your residence mortgage for many go out, you will receive quite a bit of guarantee offered. Hence might possibly be a whole lot more than you think if your family also has improved from inside the well worth.

Instance, state you got aside financing five years ago from $600,000. At the time, our house you purchased are worth $800,000. You’ve got paid down $fifty,000 off the prominent via your normal payments while the house well worth has increased from the 20% for the reason that time.

Your property is now value $960,000 and you also are obligated to pay $450,000 definition you’ve got $410,000 security in your home. By refinancing your loan, you could potentially supply several of it money to fund you to reed off.

cuatro. To minimize your repayments

A common need consumers seek out re-finance would be to dump the repayments, tend to by stretching their financing identity back to 3 decades. Exactly what that it really does is basically expand your own financial over to an effective longer period of time, which often may help you lower your costs.

Too good to be real? Yep, often it are. It’s important to note that if you extend the brand new lift out-of your loan, you can even end using alot more appeal along side longevity of the loan. A great agent can help you estimate the brand new feeling off stretching the loan title, otherwise check out the refinance calculator to help make they obvious in less than 30 seconds.

5. Personal affairs features altered

Tend to a lifestyle transform experience would be a good time so you’re able to review your finances (and you can yes, a unique little human drops with the you to definitely class). This is because a general change in your own expenses activities (ahem, alot more nappies) otherwise generating capabilities can mean your financing and money was no longer the best fit. Remember, your house financing should always progress with your lives.