The difficulties away from Dave Ramseys Property Standards

I experienced will mentioned that once i had were only available in my individual loans journey by paying attention to Dave Ramsey, yet not, have expressed that i cannot go after any one pro otherwise pundit, influencer, otherwise author consistently. Because of the hearing a number of anyone otherwise organizations and you will mode my personal very own methods about getting, protecting, using and paying currency. I’d has just posted a blog post on how hard it can end up being getting teenagers to purchase a house. Written down this, We recalled some of the conditions Dave Ramsey, and you can Ramsey Solutions have a tendency to advise to the people when buying property. I drawn you to definitely out for yet another article. Why don’t we undergo a few of the challenges out of Dave Ramsey’s home to order requirements, i believe.

In the present community where financial independence and you will homeownership will be requirements for most young people, counsel regarding economic positives such as for instance Dave Ramsey have a tendency to serves as a beneficial beacon, which have scores of followers and you may audience. Ramsey’s conditions for purchasing a property-getting down about 20% as a down payment, opting for a beneficial 15-seasons repaired-price home loan, and you may making certain that monthly premiums do not go beyond twenty five% of the get hold of pay, try to offer financial balances and get away from people from are domestic terrible. not, while you are these pointers bring a conventional path to homeownership, staying with them in today’s economy even offers its band of demands getting young adults.

Don’t get me personally wrong, I adore the thought of dropping a top down payment on the a property if you are ready, but among the many traps to homeownership ‘s the 20% down payment specifications often told of the Ramsey. For example, here in Minnesota the common household price is as much as $317,000. Ummmm, that would indicate new down-payment might possibly be over $60,000! I’m sure it isn’t really the cost of a beginning family, however it is intimate! These days, where assets prices are soaring, rescuing such a substantial count try daunting for almost all young adults, especially those grappling having stagnant wages, the fresh inflation, and you will scholar obligations. It specifications normally prolong the newest protecting phase, delaying homeownership.

Brand new 15-Year Repaired-Rate Financial Trouble

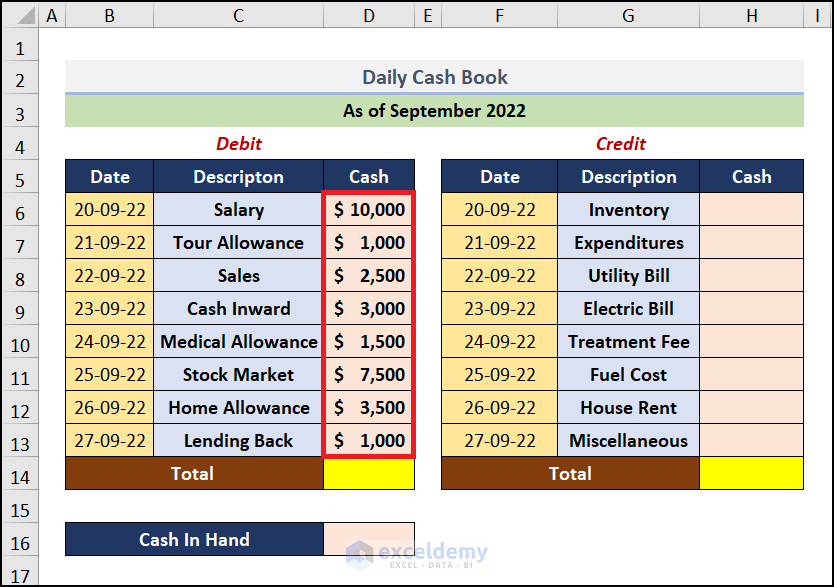

Choosing an excellent 15-year fixed-rates financial, since advised by the Ramsey, causes large monthly payments as compared to a thirty-season financial. While this approach is designed to slow down the matter paid-in notice and facilitate collateral building, it rather limits affordability to have more youthful customers. When you look at the a time where economic self-reliance is extremely important, the higher monthly union can discourage of many away from pursuing homeownership, moving them to continue leasing despite the need to very own. Let us use the analogy significantly more than. Based on a $317,000 household, and you will let’s assume the consumer eligible to an interest rate of up to cuatro%. Pursuing the deposit, the mortgage count might possibly be as much as $250,000. Now check out the difference between costs:

Restricting the fresh month-to-month mortgage payment to help you only about twenty five% from take-home shell out was Ramsey’s advice about keeping a balanced budget. I really do see the need right here. not, having increasing home prices plus the financial pressures we discussed earlier, wanting a house that meets so it criteria is actually all the more difficult. It tip is also really limit the fresh new houses possibilities so you’re able to young customers, especially in higher-consult cities in which assets viewpoints meet or exceed national averages. Following, once you in addition to comment what this will mean when it comes to exactly how much you’d need earn, its unrealistic away from unnecessary early grads, teenagers, otherwise those individuals to shop for the very first home. Give it a try. Once more, according to the previous percentage off $1800 per month, it would suggest this new monthly get hold of pay would have to be available $7,two hundred! That’s to $86,000 per year! This is exactly in love to be asked since the a young paycheck. Now that it really does be more possible for those who have somebody and therefore are collaborating. But you to dialogue from joining finances, and matrimony is a discussion for the next go out.

The necessity for Flexibility and you can Service

I do believe that purely staying with Ramsey’s standards can perhaps work and set some body upwards for achievement. not, may well not align on information confronted by many people teenagers in the modern housing market. Liberty for the strategy and you can given choice steps-particularly going for an extended home loan identity to possess lower monthly repayments, or investigating certain downpayment guidance programs-produces homeownership more attainable.

I do feel that increasing economic literacy to higher navigate this type of demands is very important. Information all options available, regarding regulators-supported loans that allow getting reduce payments to very first-big date homebuyer incentives, might help younger homeowners on the education making advised behavior.

Freedom and you can Obligations Is key In order to Homeownership

When you are Dave Ramsey’s homeownership recommendations is grounded on making sure long-name monetary wellness. Tthe functionality of using this type of conditions is overwhelming for most young adults. Of the accepting the necessity for a healthy and you can functional way of homeownership is essential in navigating the causes off today’s home sector.

Empowering themselves which have financial degree and you will investigating all avenues getting homeownership, young people find ways in which line-up with regards to economic truth, needs, and you will homeownership goals, even in a difficult financial ecosystem. Thanks a lot and don’t forget, keep the individuals horns up my pals! South Carolina payday loans \m/\m/