Because that is approximately what kind of cash you have to possess a 450k mortgage immediately after loan repayment, rates, insurance coverage and you may tools

OP is on decent money while parents is retiring are probably not in their very early 20’s thus rescuing in initial deposit by now must not was basically impossible unlike doing the contrary and you may being in loans.

One question for you is you to you must ponder : would you like to live on $1000 thirty days? The number will work recommended that you could book specific rooms inside your home, however, it will probably trust the region of the property.

Within my circumstances we targeted at getting a property i will focus on improving and you can along with some extra costs it was refinanced and were taken out of the borrowed funds in just couple of years

You’re on 84k, will pay just 1400 during the rent but have no coupons, hence throws your month-to-month expense around 3k as well as.

In my own instance we directed at delivering property i am able to work with improving and as well as a little extra repayments it had been refinanced and were taken from the loan in only 2 yrs

You are on 84k, will pay merely 1400 when you look at the book but i have no offers, and this sets your current monthly expense around 3k as well as.

Why-not ask your mothers to help you having in initial deposit instead of all of them placing their house at risk when the anything wade pear-shaped.

Agreed. I looked into it a prospective way out out-of my personal economic dramas. There was simply excessively exposure towards the parent’s long haul technique of assistance. Additionally, it economically connections your to all of them and constraints you later on.

As to the reasons? My personal mothers Given which too therefore did as a consequence of they to each other and it also ended up an excellent option for me personally and no impact in it at all.

As usual be certain that you’re better within your function in regards to speed along with your monthly purchasing just like any monetary commitment and you can work towards an-end video game of getting all of them away from the mortgage since small as possible.

So it forum seems to have just a bit of a great stigma facing guarantor given that i am aware i experienced similar views while i requested in years past. Ofcourse their a massive ask while some issues is generally some other following exploit that will maybe not succeed finest it can also be definitely functions!

Don’t hear brand new nay sayers. Guarantor is not always a detrimental topic. Its a danger for your mothers. For individuals who default, they may reduce their house. But that is something that they will need to to take into consideration.

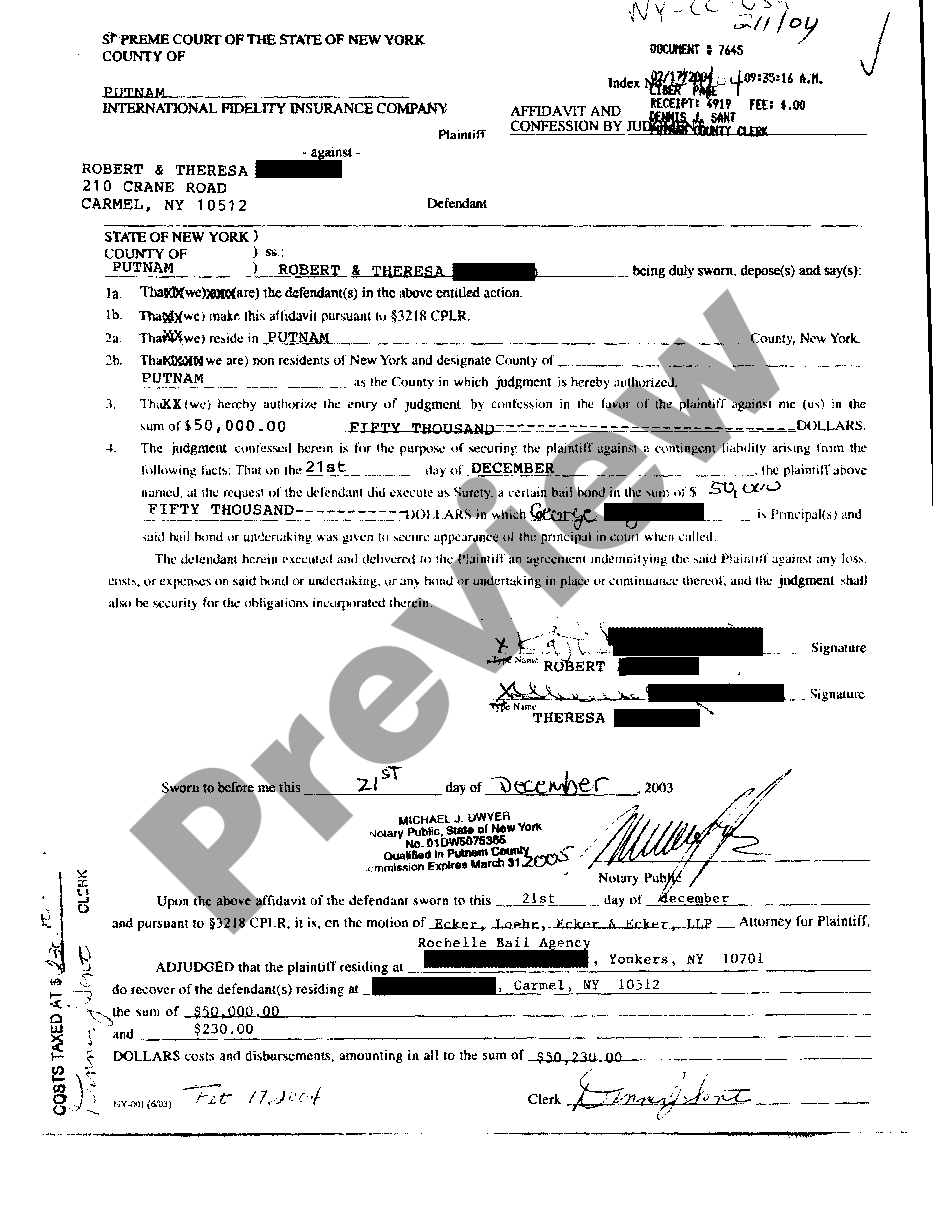

You might wade discover a simple agent and you will carry out the mathematics with them. More lenders will have other terms with respect to good guarantor. Certain allows you to obtain up to 105%. Some have a tendency to cure LMI etcetera.

You will be in a position to move your $15k into the home loan. However, be cautious. 3 decades % is a lot more cash over 3 years during the ten%. You would then need certainly to acquire over 100% when you yourself have no-deposit, you is simply for loan providers that enable one.

I practically simply have 6 months locate it mortgage once the after that my personal parents have a tendency to retire, and you will they will have paid down their 600,000 family

Dont hear the fresh new nay sayers. Guarantor is not fundamentally a detrimental point. Its a danger to suit your parents. For those who default, they might dump their residence.

How will you say it’s just not fundamentally an adverse americash loans Wilton thin from inside the you to sentence and then six terms and conditions after state they can beat their property ? You to seems like an adverse issue for me.

Such I told you, it’s just not always a bad thing. You will find some risks, however, provided they are aware ones, it isn’t too bad. My mothers went Guarantor on my earliest possessions. It knew that if we missing my work or something they may need to help meet with the payments until i happened to be straight back on my feet.